by Alex | Dec 27, 2017 | Corporate tax tips

In my previous blog “Selling assets from seller’s perspective”, I touched on the HST/GST implication on selling assets. Here is the link. Today, I will expand this topic as I came across similar issues with clients quite a few times already. Generally, if a business...

by admin | Dec 2, 2017 | Corporate tax tips, Tax tips

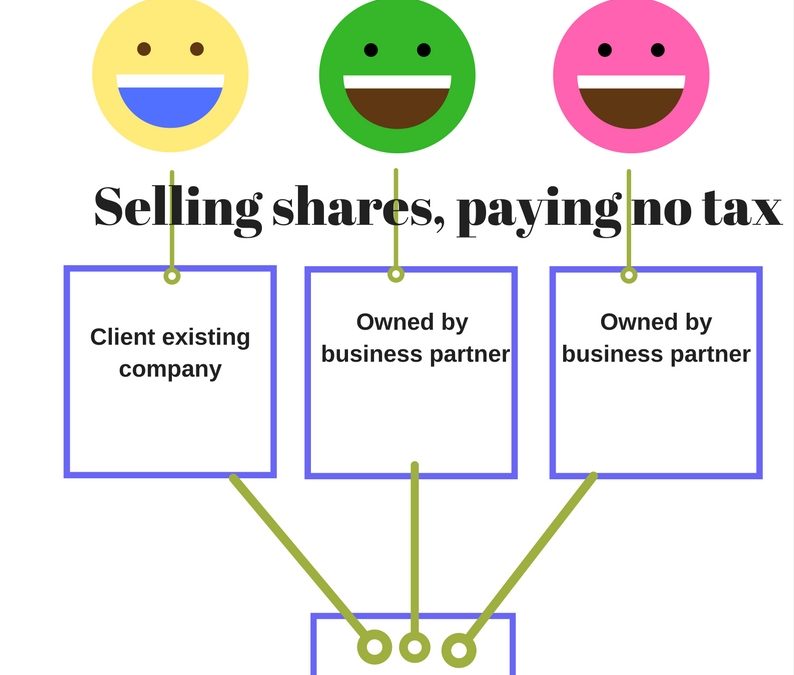

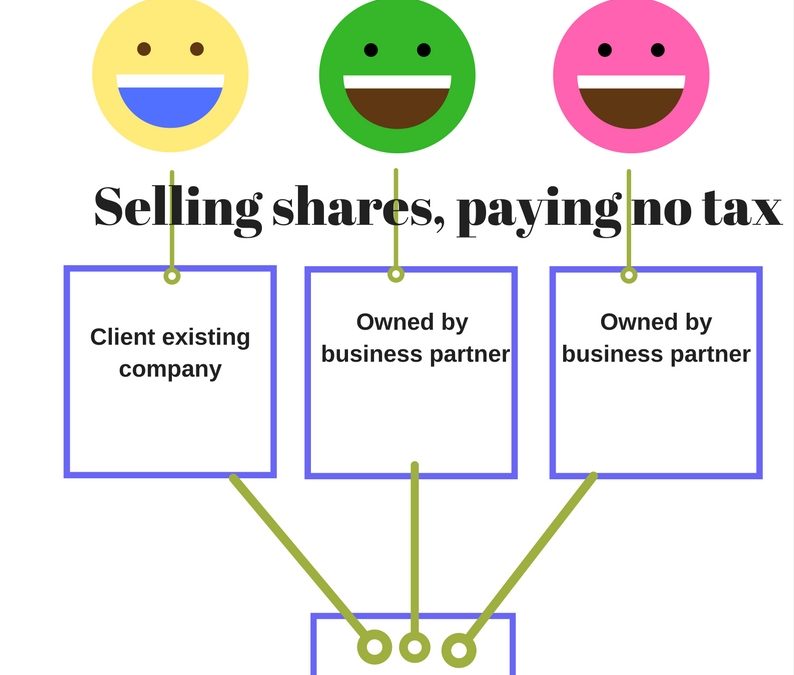

In general, selling your shares in the company that you own, you pay no tax. Why? When you own your business in Canada, assuming the company is a Canadian- controlled private corporation and at least 90% of its assets must be used in an active business in Canada, you...

by Alex | Nov 9, 2017 | Corporate tax tips, Personal tax tips, Tax tips

Selling assets in a business normally is not preferred by sellers. In some situations, due to the status of the business like continuing in a loss position or specialty of the business in nature, sellers have no choice but sell the assets in order to attract investors...

by admin | Nov 8, 2017 | Personal tax tips, Tax tips |

Claim Work from home expenses, here are some advices. Many people believe that as long as they work from home, they can deduct home expenses in reducing the income. That may be partially correct.But you have to be careful. If you are lucky enough and selected for tax...

by admin | Nov 2, 2017 | Tax tips |

After a few years, you have put in significant amount of time and effort into the franchise business. At this moment, you know the inside-out of the operation and build strong relationship with customers. You may think about selling your franchise business. What are...

Recent Comments