CA Blog

Sharing unique bookkeeping & accounting advice here

Change in corporate owned life insurance in 2017

Tax planning becomes more and more critical for many Canadian businesses. Simply speaking, the goal of tax planning is to maximize all the deductions available as well as defer the tax as much as you can to the future. Under the existing tax rules, a...

For your business: how to account for GST on coupons issued

GST, Coupons

Finding opportunities for small businesses

We haven’t written a blog on business analytics for a bit long time. But we always believe that big data/ data analytics is a powerful tool to look at things differently and gain competitive advantage in business, particularly for small businesses. PrivCap LLC, based...

How to talk to the CRA agent

If you have any questions about your tax filings and you want to call the CRA, then what should you do Here are some tips: Tip #1: be nice and polite CRA agents are human beings and they deserve respect as well. Talk to them nicely and explain the...

Non-residents’ tax obligations in Canada

In British Columbia, the provincial government has imposed 15% property transfer tax on foreign real estate buyers in Metro Vancouver. Local government strongly believe that “this tax would limit demand, making housing more affordable in Metro Vancouver.” While in...

Be real + be positive

Have you ever thought of starting a business? What are you going to face in reality once you are in your so-called business? Don't worry as you are not alone. Here is the extract shared by Ales Zivkovic, who is being called as "the Entrepreneur With 3 Careers, 2...

Tax tips from Canada Revenue Agency

It is common that a lot of taxpayers make mistakes on their income tax returns. The Canada Revenue Agency (" CRA") conducts its audit program periodically to determine base levels of compliance through the tax return database and has identified common mistakes made by...

$19 million dividend income omitted – what we can learn

Tony Melman, an ex-managing director of a well-known Canadian private equity firm, has been found guilty in tax court for omitting $18.9 million of taxable dividend income in 2007 taxation year. Gross negligence penalties has been imposed due to such huge omission....

Claim CCA on the rental property-a second thought

In the previous blog, we talked about the tax implication on claiming CCA on the rental property and time value for the tax savings. As situations may vary from individuals, all factors should be carefully taken into consideration before a decision is made. One of the...

Wedding and tax

Yeah! It is a wedding season.Brides and grooms are busy planning the wedding ceremony and reception. These days, as Wedding reception venue booking gets more expensive, family financial support becomes critical in the process for a lot of newlyweds.Generally, those...

Tax strategy on rental properties

Plan your tax before the income tax time. It's always beneficial for individuals to think through lots of issues before nailing down the property investment transactions. Today, investing a rental property becomes a hot topic conversation these days. But is it that...

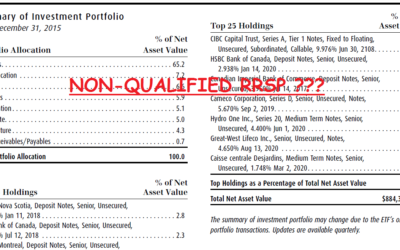

Are those qualified RRSP investment?

A client phoned in and told us his transaction over-the-counter in RRSP account has been flagged as non-qualified investment by his discount broker and the CRA may impose penalties. Calm Down Today, a lot of investors have enjoyed the flexibility and freedom in their...

Income splitting tax strategy

We are talking about tax planning again today. People forget about the planning part after filing their taxes in 2016. If you can plan it ahead and execute it properly, it may save you a lot of money. One of tax planning strategies is income splitting. How income...

Claim CCA on the rental property now!

In early 2016, Toronto Real Estate Board has reported that a substantial 20 per cent increase compared to 5,032 rentals reported in Q4 2014.The real esate experts expect rent growth to remain strong in 2016. What a great year for a lot of investors owning the rental...

Bye bye – tax savings on Corporate Class Funds

In the past, when investors dispose traditional mutual funds, they must pay tax immediately on capital gains. Mutual fund industry creates one innovative product for investors' non-registered accounts. This product is called Corporate class funds. Why it is so...

Do I have to file my tax?

It is normal to see some clients have not filed their taxes for a number of years. If you ask why, they may come back with the similar idea: “I don't make even close to $10,000 a year. It is pointless to complete the tax return.” Well, there are a few points that need...

Are you brave enough?

Are you brave enough to quit your job? Are you brave enough to quit your job at Twitter? Are you brave enough to quit your job at Twitter and start a business at 40? Here she is. Ginger, she post her story " My Life is Just Starting at 40, and I’m Bringing the Heat."...

Personal tax changes starting 2016

The tax season has come. We are not going to look back how our tax numbers work out in 2015 taxation year but also keep in mind the changes for 2016. So, what are the highlight of tax changes starting 2016 ?

The in-trust account tax implications

Recently, a few clients have asked the same question if an in-trust bank account can be used to save some taxes. My answer to them is maybe. I think it is worthwhile sharing the key points on this subject with you as well. First of all, how an in-trust account is set...

Business Analytics

Can you imagine that the sales receipts from your local stores mean a lot to store owners? If looking at the receipts carefully and using business analytics to understand what the data is about, you will find that it tells you a lot of interesting stuff about...

Here are more resources created for our clients

Charge less rental and still claim a loss – please read on

Reporting income generated from the rental property seems straight forward. If your rental expenses are more than your gross rental income, then you will have a rental loss. Simple! The beautiful thing is, if you incur the expenses to earn income, you can deduct your...

Saving tax starts from deferred income

Happy holidays to all! It’s time to relax, recharge and reflect. I initially planned to write some tax tips as a closing of 2018 like income splitting, passive income, etc. But, there are way too many articles talking about those changes and confusion happened in...

Guide on deductible business expense

When talking about the deductible business expense when running a business, business owners are sometimes confused. Today we are going to clarify the confusion. Generally speaking, any reasonable expenses you incur for the business to earn income are...

Recent Comments