CA Blog

Sharing unique bookkeeping & accounting advice here

Tax planning – salary deferral

For many small business owners, the popular tax planning strategy for year-end is to defer salary. If you don’t have a professional accountant, can you DIY? Sure. Here is what and how. What is the purpose of deferring salary? The top reason is to reduce taxable income...

Minimum wages and childcare centers

An article recently written by a social Justice reporter Laurie Monsebraaten was posted on thestart.com. The article pointed out the facts that how the change in minimum wage affects thousands of middle-class parents. The birth rate in Ontario has been continuously...

The amazing dividend: save your tax

A dividend is simply a distribution of a portion of a company's after-tax earnings. Dividends can be issued in various forms, cash payments, as shares of stock, or other property. But today, we talk about the basic cash dividend only. Do you know the amazing part of...

GST Know-how: Did you overlook GST/HST?

In my previous blog “Selling assets from seller’s perspective”, I touched on the HST/GST implication on selling assets. Here is the link. Today, I will expand this topic as I came across similar issues with clients quite a few times already. Generally, if a business...

8 tax tips for business owners before 2018

Apple just recently revealed 2017’s most popular apps, music, movies. This reminds me to write down some popular tips for business owners before the New Year-2018 kicks in. Here they are: Review the business structure and make sure it fits Why the review of the...

3 key ratios that bankers will look at closely in your commercial loan application

Small business looks for growth. Large business looks for getting bigger. To secure the financing at reasonable rate is critical for all size of companies aiming for a sustainable grow. When bankers start reviewing the loan application, they are basically looking for...

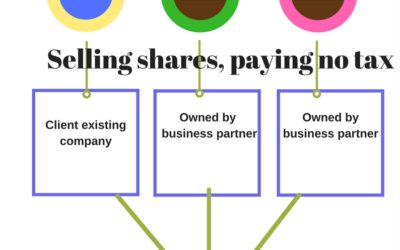

Selling shares, paying no tax

QSBC, selling shares, capital gain exemption, planning

Selling assets from seller’s perspective

Selling assets, tax implications, HST/GST issue, income distributed,

Claim Work from home expenses: 5 things that you need to know

Work from home expenses, the CRA, tax audit,tax planning

Selling the franchise business

After a few years, you have put in significant amount of time and effort into the franchise business. At this moment, you know the inside-out of the operation and build strong relationship with customers. You may think about selling your franchise business. What are...

Tax, tax, tax – an update on Federal tax proposal

To Canadian Non-residents, 4 things to watch out in your rental property filing

Non-resident tax filing, S216, rental property, withholding tax

Using a corporation to buy real estate: pros and cons

Using a corporation to buy real estate is one of the ways to partner with other investors to invest. A lot of articles have discussed pros and cons. Pros are: The corporation can provides liability protection in case the corporation is being sued by tenants; The...

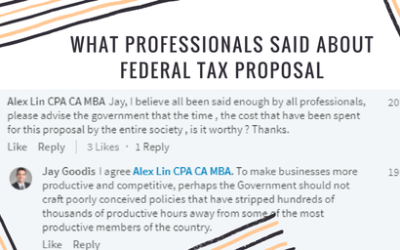

What professionals said about Federal Tax Proposal

Federal tax proposal, professional opinions, passive investment, administrative burden

GST Know-how: Best practice in reviewing your GST/HST reporting period

A lot of business owners are being advised to become a GST/HST registrant with their bookkeepers or accountants as most goods and services sold within Canada are subject to GST/HST. Once the account is registered, businesses start to collect GST/HST and file the...

Canadian non-residents, time to prepare your rental property tax return

Non-resident may consider renting out the property In order to maintain a break-even cash flow. What’s the tax impact on a rental property then? As a non-resident of Canada, he/she can appoint a Canadian agent to submit 25% of the gross rental income withheld to the...

The CRA audit: is this just an HST/GST audit?

As the real estate market cools down quite a lot, flipping houses seems becoming so distant to us. This may be true but the pace that the Canada Revenue Agency conducts its audits on individual cases is not slowing down.Recently heard about one case that one taxpayer...

Selecting a fiscal year-end is never that easy!

Tax planning, year-end, tax filings

4 myths about SR&D claims

We all admire many startups’ entrepreneurial spirit. Those folks work hard and focus and try to solve the issue, kill the pain and make our world better. One of the key items on the startup business’ agenda is to get the funding. A lot of them love their dreams and...

Bruce’s advice from TD Small Business Advice Series

Recently, a special Small Business Advice event was host by TD Small Business Banking in collaboration with Financial Post. Bruce Croxon , one of the dragons in CBC's Dragon's Den, was invited as keynote speaker for the event . If you don't know about him, let me give...

Here are more resources created for our clients

税局审计又来了- 你了解工资补贴审计吗?

...

CEWS AUDITS ARE NOT FAR AWAY

CEWS, like other new government benefits programs have been created during the COVID-19 outbreak. The goal is clear. It is to provide qualified employers with financial assistance to hire back employees that were previously laid off due to the Pandemic and put...

Deducting employment expenses (shareholder/employee version)

Regularly working from home due to the COVID-19 pandemic has become a new norm. As a shareholder, you work extremely hard to ensure the business is on the right track. Also, you are one of the employees, who may incur employment expenses as well. So, what you need to...

Recent Comments