by admin | Jun 5, 2016 | Tax tips

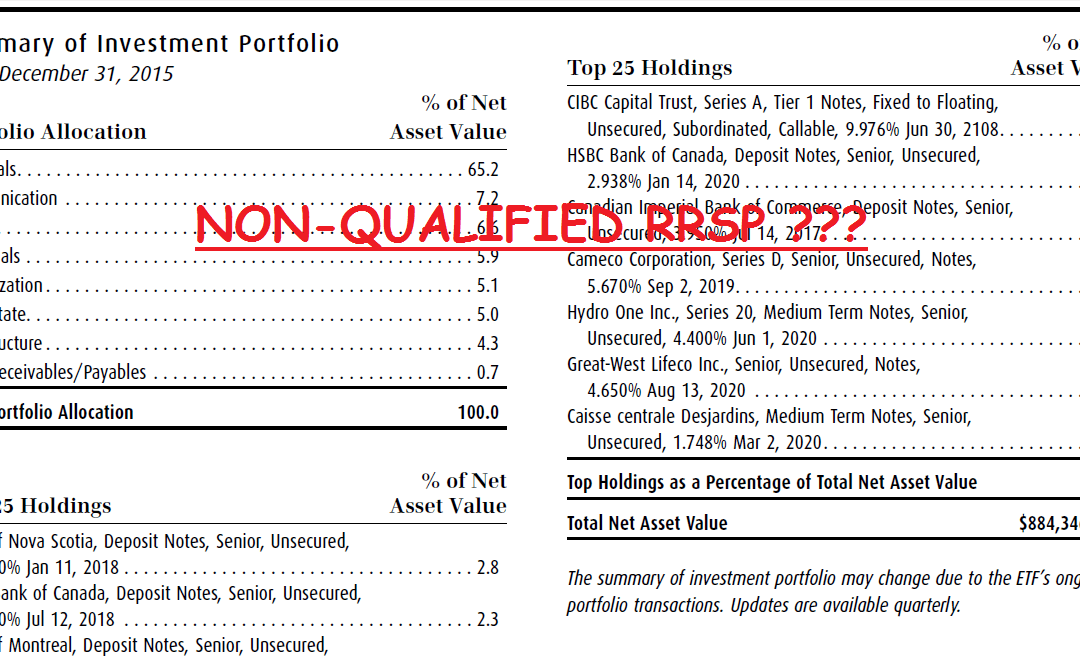

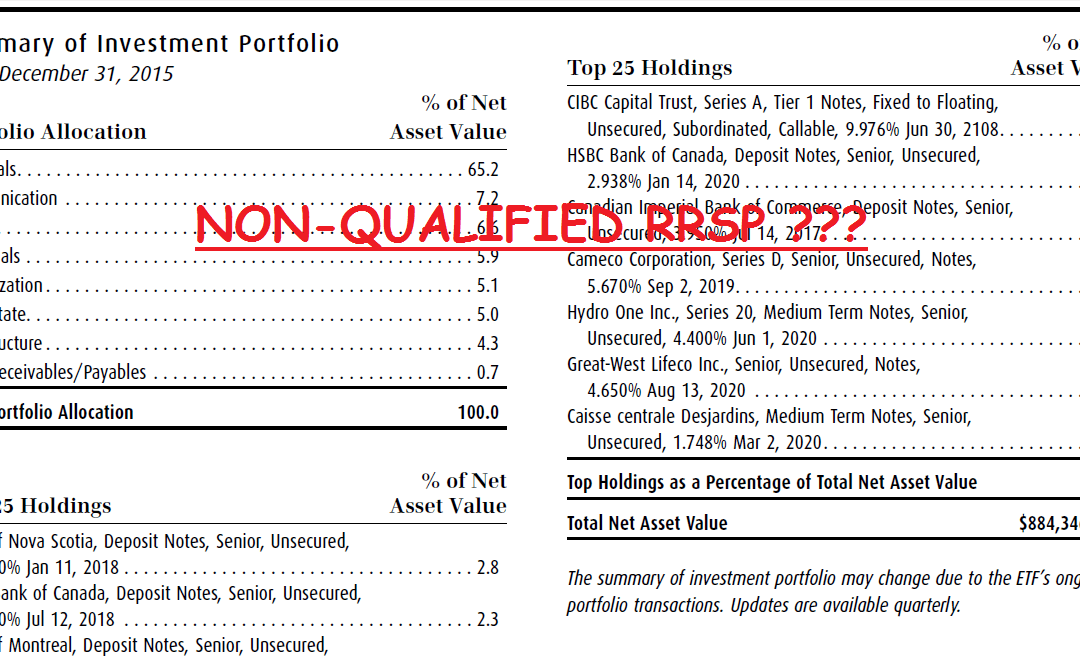

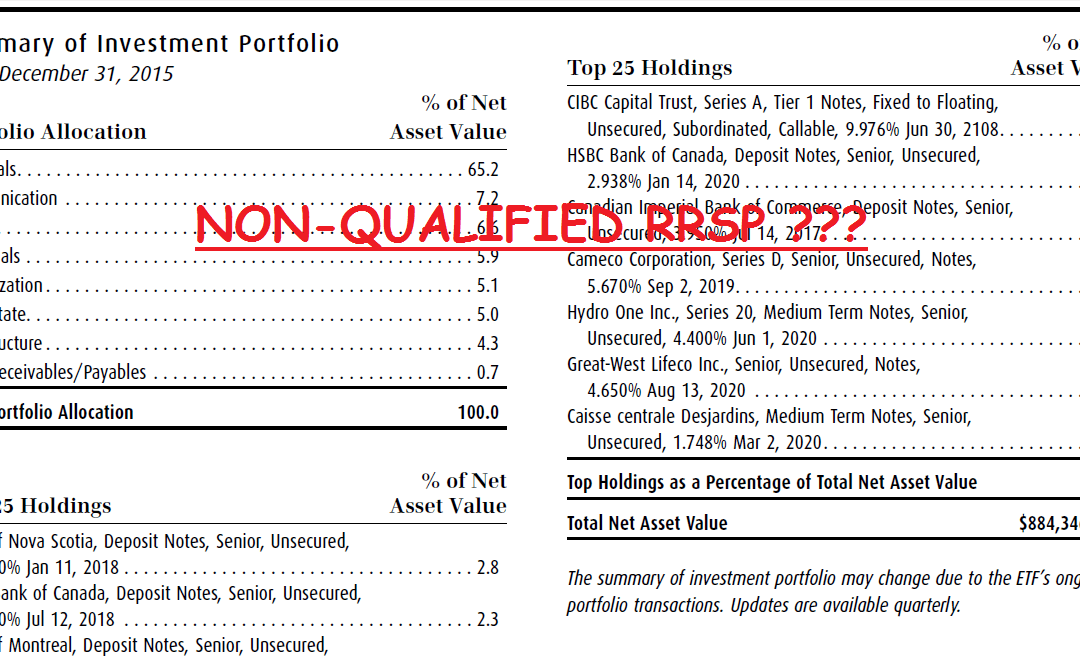

A client phoned in and told us his transaction over-the-counter in RRSP account has been flagged as non-qualified investment by his discount broker and the CRA may impose penalties. Calm Down Today, a lot of investors have enjoyed the flexibility and freedom in their...

by admin | May 30, 2016 | Tax tips

We are talking about tax planning again today. People forget about the planning part after filing their taxes in 2016. If you can plan it ahead and execute it properly, it may save you a lot of money. One of tax planning strategies is income splitting. How income...

by admin | May 16, 2016 | Tax tips

In early 2016, Toronto Real Estate Board has reported that a substantial 20 per cent increase compared to 5,032 rentals reported in Q4 2014.The real esate experts expect rent growth to remain strong in 2016. What a great year for a lot of investors owning the rental...

by admin | Mar 31, 2016 | Tax tips

In the past, when investors dispose traditional mutual funds, they must pay tax immediately on capital gains. Mutual fund industry creates one innovative product for investors’ non-registered accounts. This product is called Corporate class funds. Why it is so...

by admin | Mar 16, 2016 | Tax tips

It is normal to see some clients have not filed their taxes for a number of years. If you ask why, they may come back with the similar idea: “I don’t make even close to $10,000 a year. It is pointless to complete the tax return.” Well, there are a few points...

Recent Comments