by Alex | Nov 9, 2017 | Corporate tax tips, Personal tax tips, Tax tips

Selling assets in a business normally is not preferred by sellers. In some situations, due to the status of the business like continuing in a loss position or specialty of the business in nature, sellers have no choice but sell the assets in order to attract investors...

by Alex | Oct 25, 2017 | Tax tips

Using a corporation to buy real estate is one of the ways to partner with other investors to invest. A lot of articles have discussed pros and cons. Pros are: The corporation can provides liability protection in case the corporation is being sued by tenants; The...

by Alex | Oct 20, 2017 | Tax tips

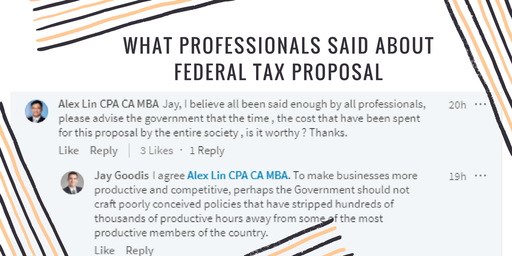

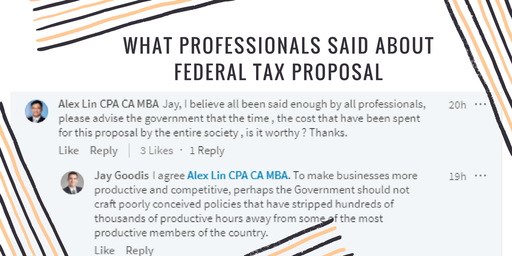

Federal tax proposal has recently gone viral from professionals to small business owners. I have been involved some discussion in the LinkedIn group and found a lot of healthy comments from professionals in various industries. What surprised me are that some obvious...

by Alex | Oct 17, 2017 | Tax tips

A lot of business owners are being advised to become a GST/HST registrant with their bookkeepers or accountants as most goods and services sold within Canada are subject to GST/HST. Once the account is registered, businesses start to collect GST/HST and file the...

by Alex | Oct 13, 2017 | Tax tips

As the real estate market cools down quite a lot, flipping houses seems becoming so distant to us. This may be true but the pace that the Canada Revenue Agency conducts its audits on individual cases is not slowing down.Recently heard about one case that one taxpayer...

Recent Comments