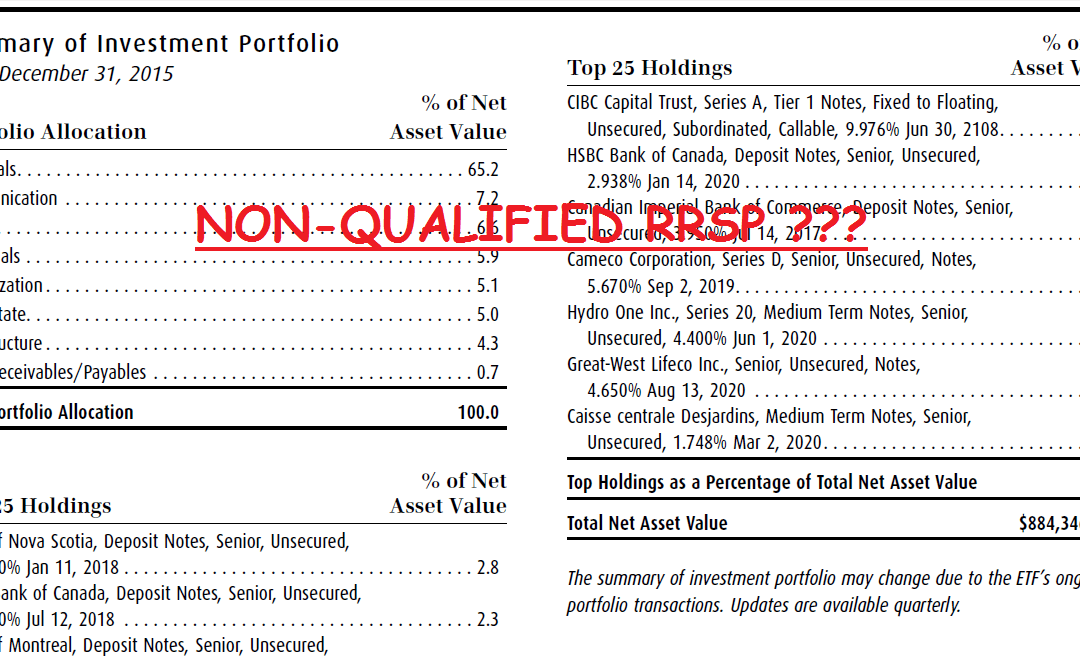

A client phoned in and told us his transaction over-the-counter in RRSP account has been flagged as non-qualified investment by his discount broker and the CRA may impose penalties.

Calm Down

Today, a lot of investors have enjoyed the flexibility and freedom in their self-directed RRSP investment accounts. As the RRSP-eligible products offered by the financial institutions continue to grow, many investors may have challenging to follow a definitive list of qualified investment prescribed by the CRA. You can have a look at Interpretation Bulletin IT-320R3 regarding definitions of qualified investments for RRSPs, RRIFs and RESPs .But they are too technical to understand.

What should you do? Generally, the popular investments such as listed stocks, mutual funds, ETFs, cash, GICs, even index-GICs qualified to be held in RRSP investment accounts. The CRA has also prescribed a list of stock exchanges to identify RRSP-qualifying stock markets. The major stock exchanges have been included. They are as follows:

· the Australian Stock Exchange

· the Hong Kong Stock Exchange

· the Tokyo Stock Exchange

· the Paris Stock Exchange

· the London Stock Exchange

· the New York Stock Exchange

· the National Association of Securities Dealers Automated Quotation System

What happen when the transactions flagged as non-qualified investment?

The client presented an interesting case. We can explain it from two aspects.

From tax perspective: If securities that trade on over-the-counters, which are overseen by a designated exchange (like NASDAQ), they do not qualify for RRSP investments. As for the client case, the trade has been put through over-the-counter; the trading system automatically raises a red flag as it may be categorized as non-qualified RRSP investment. So, investors need to pay attention to the issue if the transaction is being flagged. Here is a short list of stock exchange not being prescribed by the CRA:

· The National Association of Securities Dealers Automated Quotation System (NASDAQ) Over-the-Counter (OTC) Bulletin Board facility

· Other over-the-counter facilities like the Canadian OTC Automated Trading System

· Tier 3 of the Canadian Venture Exchange

From stock-trading perspective: You may be curious why the securities trade on over-the-counter. Generally, it happens to the companies in small market cap, who cannot satisfy exchange listing requirements. As for the client case, the securities trade very thinly and have limited volume. The broker put it through over-the-counter to directly negotiate within its network. As a result, the flag was raised. Client has confirmed with advisor again in terms of eligibility of this particular security.

What’s next?

Financial institutions are required to report information to the CRA and the annuitant when an RRSP begins or ceases to hold a non-qualified investment in a year. The deadline is no later than the end of February in the year following the year in which the non-qualified property was acquired or previously acquired. Potentially, you may be exposed to the tax, that equals to 50% of the fair market value of the property at the time it was acquired or it became non-qualified.

Conclusion

This case is unusual. The impact may be significant as you would be penalized at 50% of the fair value of the unqualified investment acquired in RRSP investment account. An easy way to comfort you is to read the prospectus first. The section “Eligibility for investment” should serve well.

As always, check with professionals.

Recent Comments