Many Canadian non-residents are shocked when they get more understand the entire process in filing the Section 216 tax returns. Well, at the time of purchase, they didn’t obtain proper advice regarding the complexity of Canadian tax requirements. I am going to talk about 4 things that you as non-residents should watch out in your tax filings.

1. What is Part VIII tax?

For those non-residents own RENTAL PROPERTY, only Part VIII will be applicable to you. Generally, Part VIII tax applies to dividends, rental payments and annuity payments as well as other types of investment income. The tax rate is about 25% and non-refundable. Similarly, Part I tax only relates to business income/employment income in Canada. Both Part I and Part VIII taxes are held at the source.

2. Withholding obligation

Non-resident realizes the importance of such tax filing later at the time when the property is disposed. Non-residents are required to pay income tax of 25% on amounts they receive as rental income on real property in Canada. As mentioned in #1, Part VIII taxes are held at the source. In a non-resident’s rental property, either appointed agent or payer (tenant) needs to submit the 25% of monthly gross rent to the CRA. In many cases, particularly tenants are not aware of such obligation.

3. Withholding tax refunded

After Section 216 elective tax return is filed, the tax is calculated based on the net rental income. In general, this will allow the excess taxes remitted to be refunded. However, if non-residents don’t file Section 216 within two years of the end of the tax year or six months from the end of the tax year if NR6 is submitted and approved, the 25% withholding tax will be final. Non-refundable! In addition, if no tax is withheld before filing Section 216, there is penalty and interest applied as well. In some circumstances, the CRA may waive penalties but still charge arrears interest for any failure to remit tax under Part XIII.

4. What if I don’t care such filing

Dealing with the CRA will never be an easy task. When the time non-resident disposes the property, the CRA will request the 25% of all gross-rents to be paid before issuing the certificate of compliance. This withholding should be remitted to the CRA along with withholding tax(a different one) on the proceeds within 30 days of the sale. You should take it seriously.

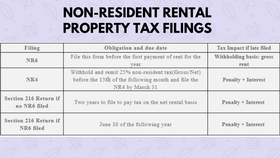

Here is the order and details of filings to the CRA.

Recent Comments