We all admire many startups’ entrepreneurial spirit. Those folks work hard and focus and try to solve the issue, kill the pain and make our world better. One of the key items on the startup business’ agenda is to get the funding. A lot of them love their dreams and don’t want to give up a large percentage of the business and managerial oversight to private investors. So, alternatively, obtaining government funding becomes critical to survive in the competitively changing world. SR&D credit is one of government incentives that startups cannot miss.

So, what is SR&D?

SR&D is the short form of the Scientific Research and Experimental Development Program, which is a federal tax incentive program designed to encourage Canadian businesses of all sizes and in all sectors to conduct research and development in Canada. The program is administered by the Canada Revenue Agency (CRA), which delivers SR&ED tax incentives in a timely, consistent and predictable manner, while encouraging businesses to prepare their claims in compliance with Canada’s tax laws and the CRA’s policies and procedures. (Source: https://www.canada.ca)

What are those 4 myths about SR&D claims, then?

-

Only the corporations that are eligible under the SR&ED program

The SR&ED program is available to any business operating and carrying out R&D in Canada. Any business that is involved in basic or applied research, or in advancing technology in order to improve or develop new materials, devices, products or processes may be eligible under the SR&ED program. Generally, the businesses are eligible under the SR&ED program fall into three groups:

· Canadian-controlled private corporations;

· Other corporations; and

· Proprietorships, partnerships and trusts.

For proprietorships, partnerships and trusts, the ITC rate is 20% of qualified current and capital SR&ED expenditures. After applying the ITCs against taxes payable, you may receive a cash refund on 40% of the balance of the ITCs earned in the tax year. Amazing, isn’t it?

-

A project has to be successful in order to qualify for the SR&ED tax credit.

The project does not need to be successful for claiming the SR&ED tax credit. However, the requirement for eligible R&D work is specific. The work can be described as identifying the obstacle, developing an action plan like milestones setup, the approach of performing analysis and testing the hypothesis. And the purpose should be clear to achieve some kind of technological advancement. In addition, the personnel involved in R&D processes need to have relevant background and experience.

-

Certain expenditures for SR&ED performed outside of Canada are not permitted.

In the past, it is a No. Now, there is a relief provided by the CRA for employees of Canadian corporations who conduct SR&ED work outside of Canada that SUPPORTS eligible SR&ED projects carried on within Canada. But watch out, payments made to subcontractors not being classified as T4 are not eligible for ITCs.

-

The claim process is too complicated.

Nothing is easy particularly in application of grants. But the CRA has made it so smooth to the applicant. Below is the process:

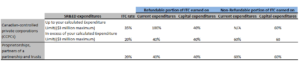

Lastly, here is the table for you to see how much your business can benefit from the SR&D claim.

Your business may be eligible for claiming SR&D credit. Do a preliminary assessment and catch the “free” government incentive before it slips through your fingers. The due date for filing the SR&D claim is 18 months from the last taxation year-end. If you need help, give us a shout.

Recent Comments