by admin | Oct 30, 2017 | Tax tips

Many Canadian non-residents are shocked when they get more understand the entire process in filing the Section 216 tax returns. Well, at the time of purchase, they didn’t obtain proper advice regarding the complexity of Canadian tax requirements. I am going to talk...

by Alex | Oct 25, 2017 | Tax tips

Using a corporation to buy real estate is one of the ways to partner with other investors to invest. A lot of articles have discussed pros and cons. Pros are: The corporation can provides liability protection in case the corporation is being sued by tenants; The...

by Alex | Oct 20, 2017 | Tax tips

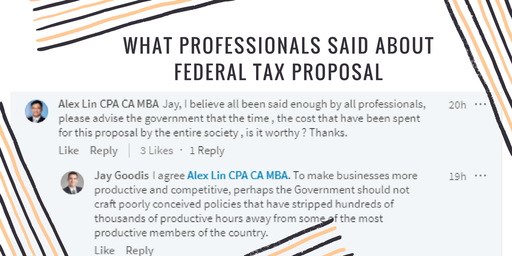

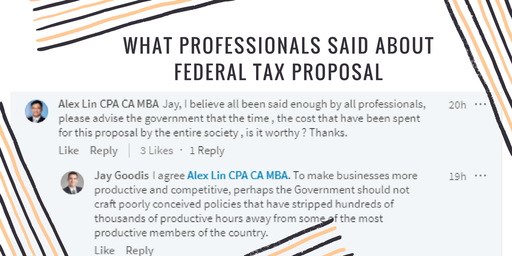

Federal tax proposal has recently gone viral from professionals to small business owners. I have been involved some discussion in the LinkedIn group and found a lot of healthy comments from professionals in various industries. What surprised me are that some obvious...

by Alex | Oct 17, 2017 | Tax tips

A lot of business owners are being advised to become a GST/HST registrant with their bookkeepers or accountants as most goods and services sold within Canada are subject to GST/HST. Once the account is registered, businesses start to collect GST/HST and file the...

by admin | Oct 16, 2017 | Tax tips

Non-resident may consider renting out the property In order to maintain a break-even cash flow. What’s the tax impact on a rental property then? As a non-resident of Canada, he/she can appoint a Canadian agent to submit 25% of the gross rental income withheld to the...

Recent Comments